2020 was brutal in many ways:

- Nearly400,000 Americans were killed by COVID-19.

- Unemployment peaked at 14.7%, the highest since the Great Depression.

- Hundreds of thousands of businesses failed, and entire industries, such as travel and restaurants, were devastated.

- GDP contracted at a stunning 31.4% annualized rate in the second quarter, and the full-year GDP for 2020 was a negative 3.5%, the worst year since World War II.

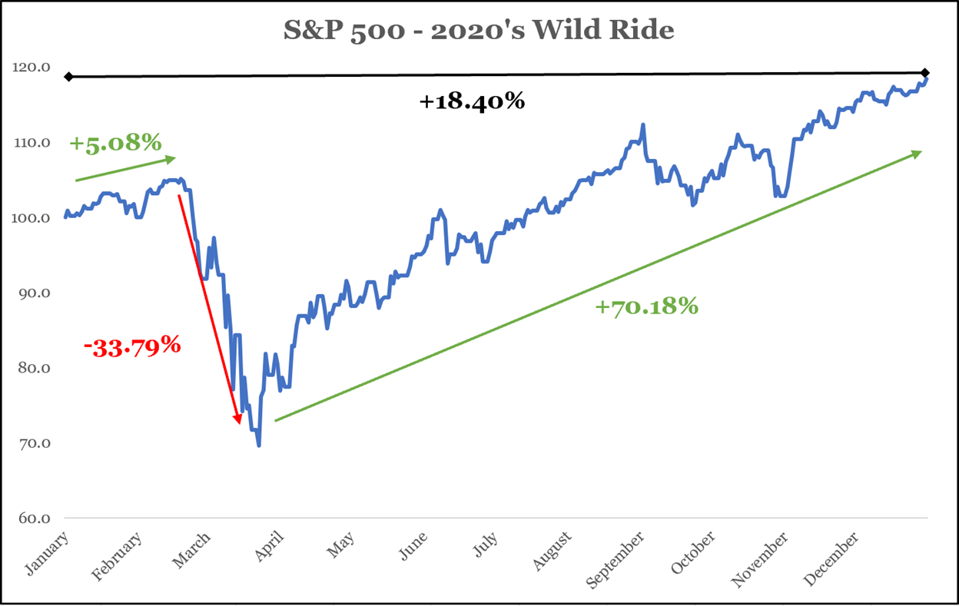

Despite all this bad news, the stock market had a great year. After experiencing the fastest 30% drop in history, the S&P 500 rebounded 70%, ending the year with an 18.4% total return.

What can we learn from this? 2020 emphatically confirmed two fundamental principles of the stock market.

Principle One: The future is impossible to predict

On December 31, 2019, I was at a party at a condo in Vail and spent the first week of the year skiing. I was looking forward to another beautiful year – a steadily growing business, vacations and travel, and a full social life. Thinking back to that week is unnerving because I had no idea what was coming.

As we look ahead to 2021, we don’t have any better idea of what the future holds than we did a year ago. That uncertainty makes us uncomfortable, so experts keep forecasting stock market returns to soothe us. As I recently wrote in my article What Will The Stock Market Return in 2021, we should ignore expert predictions because they are only ever right by accident, and they are furthest off the mark when we need them most.

Principle Two: The stock market is not the economy

That the economy is tanking or booming doesn’t mean the stock market will do the same. 2020 confirmed that the economy and the stock market can head in different directions.

In March of 2020, I published an article in Forbes titled Why The Looming Recession Doesn’t Mean You Should Sell Out Of The Stock Market, making the point that the stock market is not the economy and that the two only correlate very weakly. So the economy entering a recession didn’t portend that stock returns would be bad. Since that article was published, the stock market has gained 45%, and people have asked me how I knew it had nearly bottomed. The question misses the point: I didn’t know what the market would do. It went up. It could have gone down. I didn’t know. And I still don’t.

In July 2020, I published the article Why The Stock Market Doesn’t Make Any Sense which explains that the stock market is a complex adaptive system. Viewing the market this way explains why it can be up when a pandemic is raging and why it’s impossible to predict what it will do.

In a complex adaptive system, understanding each component doesn’t help us understand the results of the system as a whole. System-level outcomes are often greater than the sum of the parts because the system is composed of heterogeneous actors (called agents) who interact with each other in ways that cannot be predicted. In a complex adaptive system, agents learn and change their behavior—sometimes rationally and sometimes irrationally—as circumstances change. Their changing behavior can create feedback loops as the output from one result becomes the input to the next iteration. Negative feedback often creates stability, while positive feedback can amplify small actions into large and unexpected events. Positive feedback loops create system-wide outcomes that cannot be predicted by observing the individual actions of the agents.

Putting the Principles into Practice

It’s disconcerting that we can’t know what will happen in the stock market because we’ve evolved to look for patterns that help us predict the future. It is one of our basic survival mechanisms.

However, it’s liberating to realize that there is no point in minutely following the market and reacting to every piece of news. It’s essential to embrace the uncertainty and keep a big picture view if you want to invest successfully.

Here’s a story that illustrates why. During the first week of March 2020, I had my last face-to-face client meeting prior to the shutdown. At that point, the stock market was in free fall, and my client was trying not to panic. At some point in the conversation, she made the point that “nobody could see this coming.” I told her that I had been following the pandemic closely while it was still in China and had read articles by infectious disease experts that predicted it would make its way to the U.S. and spread. So, we did have some advance warnings. She looked at me incredulously and asked, “Well, then why didn’t you do something? Why didn’t you have us sell out of the market?” I told her that we didn’t advise clients to sell out of the market because we wouldn’t know when to tell them to get back in the market. It was likely that by going to cash, our clients would miss the rebound when it came. Once you are in cash, it is a lot harder psychologically to put it to work when things are scary than it is to stay invested. Things turned out well for her and our other clients. They didn’t sell out of the market, and they fully participated in the market’s amazing recovery.

This article was legally licensed through AdvisorStream